CREDIT GUARANTEE FUND (CGF)

LiNK’s fund aims to act as a guarantee for members’ credits which they want to lend in the banks, and at the same time, it is a signatory to the credit agreement.

PURPOSE:

• Encouraging the development of a small economy

• Fostering investment

• Opening new jobs

ACTION

• Giving guarantees to 50% of the requested credit amount

• Promotion

• Professional help

ADVANTAGES FOR ALL INCLUDED!!!

MEMBERS

• Easier access to credits

• Favorable lending terms (interest, commission, insurance)

• Counseling and preparation of credit applications

GUARANTEE SCHEME LiNK

• Clearly agreed on rules

• Supporting entrepreneurship

• Strengthening bargaining power

• Enlargement of the credit fund

BANKS

• Expansion of the scope of the clients

• Verified borrowers – clients

• Good name the local community

• The new product on the market

• Risk allocation

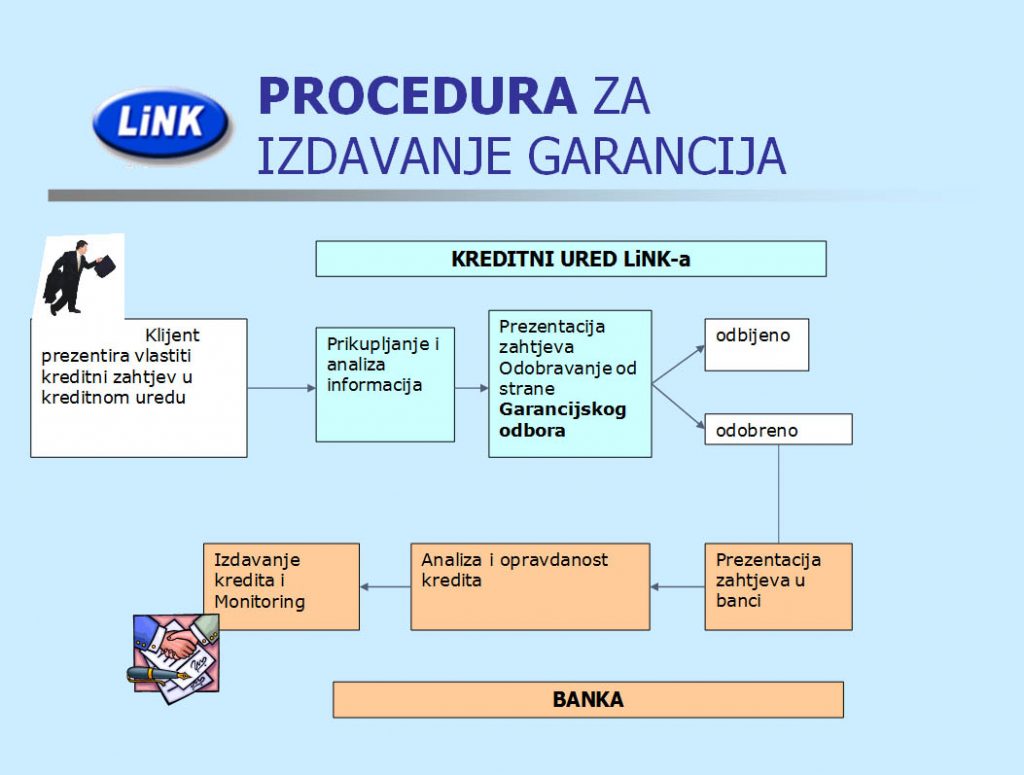

PROCEDURE FOR ALLOCATION OF GUARANTEES

• The entrepreneur comes with a credit application in the credit office of the Service Center LiNK

• The Guarantee Service, if necessary, updates the business plan, analyzes the client and the entrepreneurial project in order to present the most reliable clients to the Guarantee Committee of the LiNK Association

• The LiNK Guarantee Committee considers the detailed requirements that the Guarantee Fund has rated positive, and approves the final credit claims and presents it to the bank.

• The Bank reviews the requests and issues the credit

• The Bank monitors the credit

This credit line is intended for registered legal entities (craft or company), which deal with production or production-service activities in the Herzegovina region. The fund was founded thanks to the Italian non-governmental organization COSPE which provided funds through its projects financed by the Italian government. So far, the LiNK Association has issued 227 guarantees for small business credits, with which 400 jobs were created, and 865 jobs were supported.

The total value of the Fund is 3 million KM, and it works on a revolving principle.

LiNK signed with Unicredit Bank a contract on joint lending to entrepreneurs, members of the Association.

CONDITIONS FOR CREDITS

• Credit amount from 5,000 to 50,000 KM

• Repayment period of 5 years (including grace period up to 6 months)

• The interest rate is 7.49% per annum for the rest of the debt

• A credit processing fee of 1% is calculated as a lump-sum for the amount of the approved loan and is charged by Unicredit Bank d.d.

• The LiNK Association charges a one-time fee for the LiNK association of 1-1.5% Association.

WHO CAN APPLY FOR CREDIT?

• Members of the LiNK Association,

• Those who are engaged in the manufacturing and production-services sectors,

• Registered legal entities,

• Those operating in the Herzegovina region,

• It is desirable to create new jobs.

RIGHTS AND DUTIES OF MEMBERS – BENEFICIARIES OF CREDIT

• Acceptance of the Regulations

• Guarantee commission 1-1.5% one-time per approved the amount

• Cooperation in decision making through the Guarantee Committee

• Assistance in preparing and completing applications

• Securing the necessary documentation

• Filling out a guarantee application.